The stewardess’ face creased with sympathy, looking at me.

Arms under my shirt, I gripped my goosebumped biceps and pulled my bare legs up in a ball. When they’d asked for volunteers to check their carry-ons, I had done so, forgetting my plane layers — a jacket, scarf, and socks — were in there. Sitting in the window seat, it felt like just a thin sheet of aluminum foil separated me and the -48°F air at 30,000 feet. It sucked the heat from my very bones. I felt so cold it hurt, on a five-hour flight.

“I’m so sorry,” she said, “I don’t have a blanket for you.”

The entire cross-country trip became about rubbing my legs, trying to arrange my hair in the warmest way possible over my shoulders, shivering, and waiting. We finally landed and I hopped up to rush off. I shouldn’t have been as surprised as I was, but what I saw in the aisle ahead stopped me.

There, in business, and there, in first class. Blankets.

Blankets, blankets, blankets. Blankets piled in corners. Blankets in every seat. Blankets still square in their wrappers.

That human person knew she had a blanket for me. But that stewardess, bound by her role and the rules of the system, knew she could not give it to me.

I wonder if a doctor will ever look at me with the same face.

The American medical system terrifies me

Recently, I got a piece published in McSweeney’s that satirized what it feels like to work outside of traditional work structures, as far as health insurance goes.

The whole system is completely ludicrous, that people who work a corporate job 40 hours a week seem to deserve to live more than people who don’t.

I don’t know that I won’t die of freelancing one day. I can’t predict that I won’t get some disease through which, if I’d been a marketing manager at Amazon on some behemoth plan, I could have afforded to live. But because I’m a writer and entrepreneur, well, have fun divvying up my mugs and don’t forget to burn my journals.

The best I can do is mitigate my risk.

Every earnest essay could be a satire piece

This piece of satire is an earnest essay reflected on the dark surface of my pit of despair.

I’ve written so many drafts and submissions attempting to capture all that I’ve felt about insurance:

- From the time I interned at Health magazine and was the first person to see reader letters, so many people asking for help with nowhere to turn but a magazine’s advice column.

- From the time in Thailand I met a firefighter from Australia, who was on his nine weeks of annual vacation. We were talking about the differences between countries and the medical debt in the US. “Medical debt,” he repeated, “I can’t even fathom the term.”

- From me crying on my therapist’s couch about being so bad at all the insurance stuff. “Or is this just something that’s hard for everyone?” she asked.

- From pitching a story about how the Kardashian’s show displayed their healthcare along with their mansions, cars, and parties, because healthcare is as much a fantasy for most of us as the rest of it.

- From watching my grandmother, who was not at all poor, still have to die in a shared room where her neighbor on the other side of the curtain was watching a tawdry Sally Jesse Raphael episode while we all held her hand for the last time.

- From paying $490 a month for insurance all of 2020, then switching to the cheaper $157 insurance that the guy who was supposed to be helping me navigate the system said, “looked too good to be true.” He told me I should double-check it. If he didn’t understand it, how was I to?

- From trying to book with my dermatologist to get my check up to see if my skin cancer was back, and being told she was now out of my network and I’ve have to pay out of pocket, though I’d have to call billing to get the billing code if I wanted to find out how much that would be and bye let’s just ignore all this forever thank you I’ll just scroll through Instagram instead.

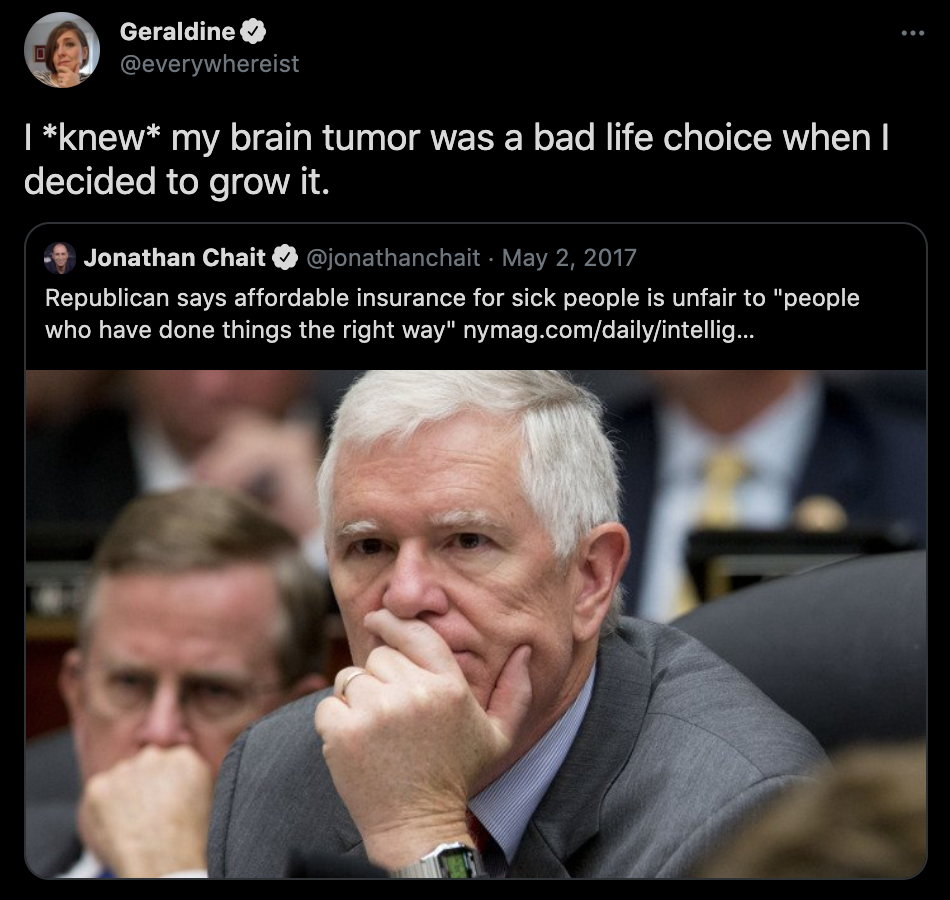

- From Geraldine DeRuiter’s brain tumor.

- From literally looking at guys on dating apps and realizing some of them could keep me alive more than others because they must have great insurance.

- From limping for the last two months because of a problem with my Achilles tendon that I’m not having checked out.

- From feeling like I’m reading all the books and doing all the thigs and I still feel terrified.

I’m feeling a truly heightened baseline of anxiety while writing this post. I don’t want to have to talk about this. But I know one person who’s reading this is going to get insurance because of it, and that is going to save that person’s actual or financial life one day. (Is it you?)

If you feel like running away from this topic, I totally understand. But it’s just too important to ignore. Love yourself enough to push through the discomfort and do what you know you need to do for yourself.

You need health insurance

The system is messy, confusing, unfair, and hard to deal with, but you need health insurance. This is the game. I would love for the game to change one day. But today, this is it.

I know it seems like a waste of money. But insurance is a huge part of risk mitigation. It’s all about the fact that we never know what’s going to happen.

Yes, I was perfectly healthy at 23. But my age and lack of pre-existing conditions didn’t stop me from getting attacked by a pit bull. I was so happy to be able to have someone put my skin back where it belonged.

I’m 38 now, and I take care of myself by exercising and cooking for myself as much as I can, but having health insurance is a top priority, above travel, eating out, Netflix, new clothes, any of it.

My family went without insurance for TWO YEARS when I was young because we were truly financially screwed, and I can’t imagine the stress that put on my mother. So I understand that some people are living in poverty and can’t afford it. I’m talking to you if you feel like you can’t afford it, but you live in a little bit cooler (and costlier) neighborhood than you have to, you live without roommates, you hit the DoorDash two nights a week. Being able to afford health insurance is worth changing your lifestyle for. Because of all the people who file for bankruptcy in the U.S., 66% say it has to do with medical bills.

“It’s easy to underestimate how much medical care can cost,” says an article on Healthcare.gov. “Fixing a broken leg can cost up to $7,500. The average cost of a 3-day hospital stay is around $30,000. Comprehensive cancer care can cost hundreds of thousands of dollars.”

We talked about this in a session of A Very Important Meeting, and one of the writers there mentioned that her daughter got insurance once she understood what a burden she might become to her family if anything were to happen to her. So if you can’t do it because you love yourself, do it for the people a medical catastrophe might impact.

How to get help signing up for health insurance

Here’s some good news. People are waiting to help you. Agents and brokers provide assistance at no additional cost to you. Click here to find local help. You could also call a helpline listed here.

Terms to know:

One of the issues with insurance is that they made up their own, terrible language to describe it all. Here are a few gems to know:

Premium

The monthly payment for the insurance itself. As in when someone from Sweden asks why Americans pay for insurance, and you say, “It’s the premium we pay for living in the best country on earth.” (Sarcasm meter on yellow.)

Deductible

The amount you can pay per year before your insurance kicks in. The amount that will be deducted from your life before help arrives. As you can see below, my deductible is $8,550. Which means if anything happens, I’m on the hook for that amount. It is essentially a kind of catastrophic insurance. It would suck terribly to have to pay that much, but it would not throw me into bankruptcy, cause me to have to move in with my mother (again), or take away my writing life.

Network

This is so important. As a human, you might think: I hurt, I call a doctor, I make an appointment, I go to it. Nope.

You have to make sure that doctor is in-network beforehand. Here’s what my insurance says on my schedule of benefits:

“Except for Emergency Services, You must receive Covered Services from Participating Providers; otherwise, the services are not covered, You will be 100% responsible for payment and the payments will not apply to Your Deductible or Annual Out-of-Pocket Maximum.”

We can talk about why they’re weirdly capitalizing things here later. Essentially “participating providers” means doctors in the network. Usually your insurance will have a place on their website where you can search for which providers are in-network.

Out-of-Network

A doctor that is not in their magical little friend group, and hence not covered by your insurance. If you make the mistake of going to a doctor (like a normal human) and then try to get it covered, you’ll get hit with a huge bill. I’ve done this so many times. The doctor themselves can also tell you if they’re in your network.

Provider

A doctor. Ok, so it can also be a pharmacy, lab, or clinic. It’s anyone providing you with medical services.

Anxiety attack

That thing you might feel rising in your chest right now. But I promise you that facing the need for health insurance and getting some for yourself is one of the best things you can do for you.

You will have to deal with this for the rest of your life, so grab a friend, get the help you need, learn the terms as you’re confronted with them.

Getting insurance for yourself is an act of love and an act of self-care. If it feels terrible, that’s because the system is terrible. But you are worthy of the best protection you can afford.

Ok, I promise to go find a new, in-network dermatologist right now…