It’s spending season. The sun shines upon Seattlites at University Village as I run to the Amazon book store, because it’s the only place to return the clothes I bought on Amazon. The next thing I need to order is a tazer to taze myself every time I even think about ordering clothes on Amazon.

The warm air puffs the smell of Molly Moon’s $7 ice cream cones into my face, and the siren of Starbucks sings of iced caramel macchiatos. People eat tacos on patios. In the distance, Anthropologie beckons me to treat myself to a nice flowy summer dress.

We are celebrating. We made it through the winter.

It’s difficult to unlatch spending from celebrating. Celebrating is a kind of excuse. And in Seattle, summer is the ultimate excuse, a story you can tell yourself about why you should be allowed to spend on this, now, the way I allowed myself to spend $25 to go to the Pride block party last weekend. Because summer. Because Pride. Because sun.

I’m a writer. I’m good at writing stories. My preferred genre is The Reason I’m Allowed to Spend This Money.

To have a come-to-Jesus moment, as they call them, is to admit you’re living the wrong story. Don’t worry, I have one of these about yearly. And it’s time again now.

It feels like a mirage, because my writing and business life are going well. My book has a 4+ star review on Amazon, it was picked as one of Poets & Writer’s Best Books for Writers, and I have a relationship at The New York Times and quality content marketing clients. I have a free year of daily word prompts set up, a store on Society6, affiliate programs, coaching courses, online writing programs being sold through two writing centers, a daily social media post plan. I’ve been working it. I feel functional, professional, confident, and growing. Like I have my life together, as a writer human.

And yet. I have $300 in my bank account, and my health insurance is due. My fuck off fund is drained, and if I ever got in real shit, I’d have to sell my car. I’ve gotten 6 NSF charges of $25 each in the first half of 2019, and I’m $5,000 in credit card debt. I owe my mom $4,000. What I’m doing is not working, in a big, red flag-waving way.

I don’t want to be frugal, but I want to be a writer. Though I’m working to design a wide-reaching and stable business around myself as a writer and teacher, I have to accept that this life is financially difficult-ish for now, and that I can’t get by without paying serious attention to the details, making plans, and saying no to myself. *Falls to floor screaming and kicking and pounding the ground.*

Seattle has gotten way more expensive. So even though it feels like my standard of living has actually decreased a bit (I rarely go to bars, clubs, shows, plays, and talks anymore), I’m spending more. And I’m a full-time writer. I pay my own insurance, don’t get paid vacation, have to pay taxes out of everything I earn, buy my own office supplies. It’s real-deal. I’m underestimating how hard it is.

Things I already do to save money:

- Use the library. Audiobooks via overdrive and traditional checkout. I think I saw some tv on there too. I’m gonna check that out. Oh my god you can get free magazines here?!

- Make coffee or maté at home. Maté is probably about 10 cents a serving at home, and I love my Aeropress for coffee. (And you know that’s an affiliate link, because: writer.)

- Freeze meals. When I remember.

- Cook or eat my boyfriend’s exquisite Persian food. I love to cook and so does my partner, so we should be doing it all the time. I hath made this:

Things I waste money on:

- Shellac manicures. The only way I found to stop biting my nails into bleeding, throbbing messes is to get a shellac manicure. I’m going to learn to do them at home.

- Subscription services. Stock photos, tools, graphics. I use a lot of services that I pay for monthly. Time to examine those more closely.

- Hangriness. If we’re hungry and we haven’t planned, we will go out into the dining shark-infested waters of our neighborhood, where we have about 20 restaurants within 2 blocks.

- Ubers. I could take public transportation more often, which just takes a little more planning.

- My car. Between insurance, parking tickets, and maintenance, I’m sure I should financially get rid of it. But honestly, I probably won’t.

- Hipster bullshit. I bought a $5 dozen of eggs that had a flier of the Bird of the Month in it. I bought it because it had a quirky-designed cover. I should just consider quirky graphic design a warning sign. But yeah, if it’s artisanal, small-batch, and twice the price of the other shit, I’m like ooh pretty, in the cart with you!

- Mistakes. Forgetting things (iPhone cable in LAX airport: $40), breaking things, losing things. These all cost money. And I do them a lot.

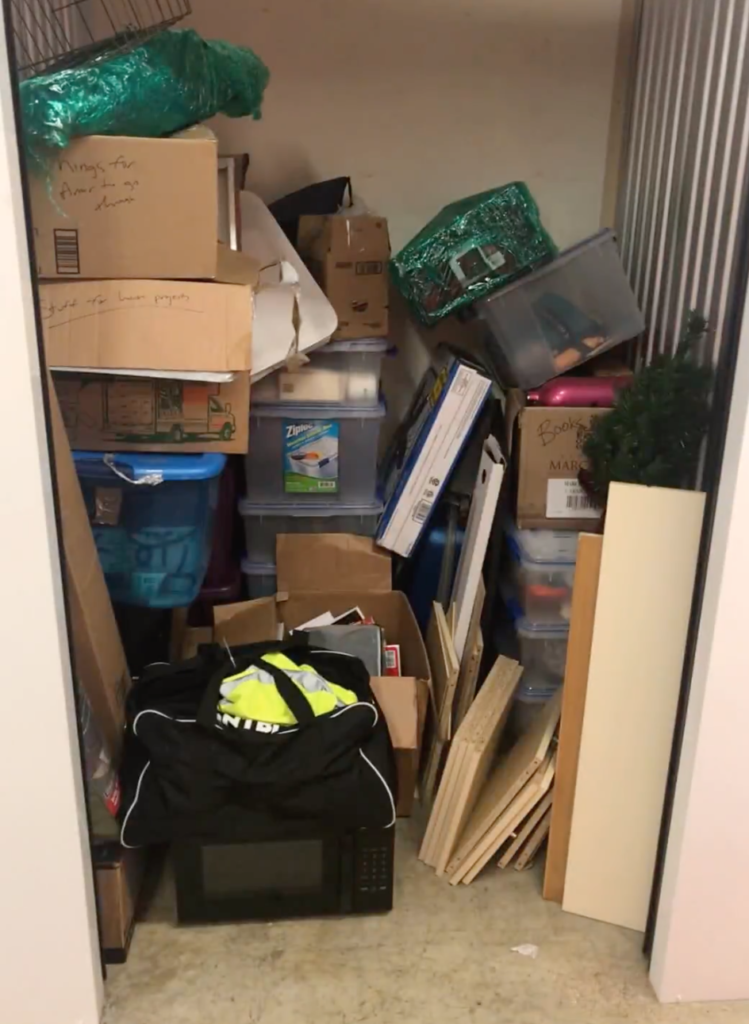

- My storage unit. It costs $73 a month, and it’s all clothes I’m too heavy for, memorabilia I could scan, old notebooks, more fucking books, and random pieces of Ikea furniture.

Things I pay for and value:

- My yoga membership. Health is such an important investment, and when I need that social pressure to complete a class. If I try to do yoga at home alone, I’ll just nap instead. I know me.

- Adobe Creative Cloud. Adobe gives me superpowers and I’ve invested a lot in learning it, from Audition to edit my podcasts to Illustrator to design infographics for my clients. My goal is to be a full-stack creative, and Adobe is the best tool to get there. Plus I’ve already drank all this Kool-Aid.

- Health insurance. It’s $326 a month, and I have friends who choose to live without it, or legitimately cannot afford it. But this country will let you die in the gutter and/or go bankrupt if you don’t have it, so I play their game and pay. My family went without health insurance for two years when I was little, so it’s one of my most prized possessions.

- Conferences. I love going to conferences, and I don’t think they’re a waste. I got my best anchor client I have right now at one. But I might have to put a pause on them for a while.

- Education. I hope I take writing classes for the rest of my life, but I’m not taking too many right now.

- Travel. My boyfriend and I both made a life-long commitment to see the world, and I understand that means sacrifices. I don’t need boujee travel, but I want to see this earth and understand reality in that way.

Things I’ve Arranged to Get for Free

- Writing guidance. I facilitate a writing workshop out of people who have won a particular fellowship I got in 2013. It’s been the perfect way to keep pushing myself and leverage that experience.

- Tickets to events. I exchange photography for entry into readings. It’s a win-win.

- Workspace. Hugo House offers a free community space for writers. When I sit at a coffee shop, it’s easy to spend $20 a day.

How I’m Moving Toward a More Frugal Life (Until I Can Afford to Spend More)

Here’s what I truly think: I’m setting up a business that will support me for the rest of my life, but I’m in the first few shaky years. It will get better. I will make more. I’m a writer, but I’m also an entrepreneur. Even though I tried to fight it, I spend money on things. My goal is to act more frugally until my business takes off, and in case it never does in the big way I’d like it to.

For now, I turn to personal finance, where, after my fuck off fund story, I was welcomed in and befriended by some of the smartest and savviest women in the biz. They’ve helped me grow my business and take my writing more seriously as the business it is, but I need to focus on the budgeting, cooking-at-home, and frugality end of it. Those are like the opposite of my favorite words.

I’m starting with the help of someone I deeply admire, Liz Frugalwoods. I interviewed her for a story not too long ago, just read and loved her book, and found her just-in-time frugal challenge!

Want to join me? Click on the image below to sign up, and let me know you’re in with me on Twitter, Facebook, or Instagram!